EthiFinance Analytics is EthiFinance’s quantitative research and development (R&D) department. The R&D team is made up of research engineers specialized in various fields (data analysis, financial modeling, climatology and geosciences) divided into two areas of expertise:

These departments collaborate in synergies where non-financial and financial factors interact, in order to obtain quantitative solutions to the problem of double materiality.

EthiFinance Analytics engineers create, implement and disseminate models and methodologies linked to the assessment and management of financial and non-financial risks for financial institutions and companies. In addition to practical applications, Analytics actively contributes to scientific knowledge by presenting their results in articles published in academic journals and at scientific conferences. By combining their expertise, they then deliver robust tools and solutions to financial institutions and corporations, with regular academic peer review.

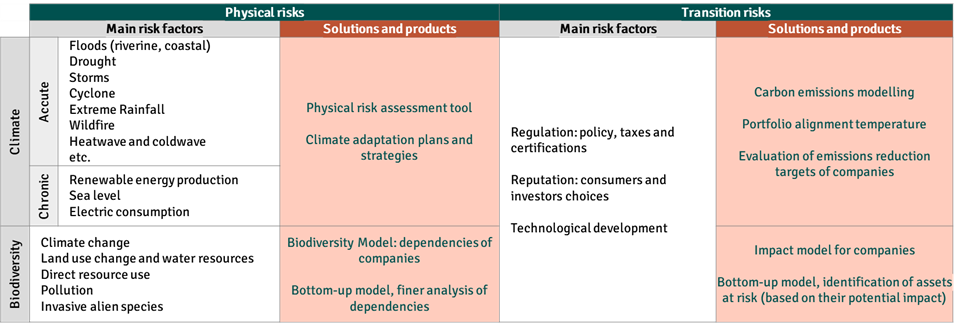

Environmental Services create models and solutions for companies and financial institutions that need to integrate environmental considerations into their risk and business management.

The products and services are listed in the table below.

Financial Services creates solutions for institutions to improve their financial risk management. As a financial services provider, we develop methodologies, models and products to be tailored to your needs through cooperation and co-construction with you and your team. This enables you to internalize the knowledge and tools, and strengthen team commitment to fully exploit these unique models tailored to your needs.

Thanks to a multi-disciplinary team, we have been able to consolidate climate, environmental and financial models into a single framework: the indicators calculated on one side are used as impact or risk factors on the other. Since our approach is quantitative as long as no opinion is required, we can more easily connect these three universes together and obtain a quantitative double materiality.

We develop all methodologies, models and implementations ourselves. In this way, we are not dependent on external models, and can adapt solutions to scientific developments and customer requirements. What’s more, because we are familiar with the intermediate stages, as well as the limitations and assumptions of climate-financial models, we can intervene in financial institutions at any stage in the development of in-house solutions.

The Analytics team is made up of PhDs, for whom academic rigor is second nature. From understanding your needs to final formalization and implementation, we apply what we’ve learned from academic research. All our sufficiently innovative solutions, considered as interesting for scientific community, are published as academic papers in international journals and/or presented in academic congresses.

For financial institutions wishing to have their own in-house solution, we implement our models in your quantitative frameworks. Our source codes are modular and can be easily integrated into your in-house solution library. As a result, you will no longer be dependent on an external service provider and will be able to leverage our innovations in other projects.

Global for physical assets (real estate, key physical assets of companies, infrastructure assets), and corporate and sovereign counterparts

Global for corporate counterparts, real estate assets

Global for corporate counterparts, real estate assets

Global corporate, real estate, sovereign